Monday, 28/10/2024 | 11:54 GMT by Nitzan Boyarsky

- The current cost of compliance for financial services worldwide is a staggering US$206 billion, equivalent to 12% of global research and development expenditures.

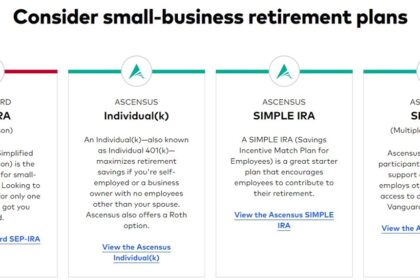

- Many AI-based platforms cover the entire compliance lifecycle – from policy setting to enforcement, correction, and audit.

Imagine a fintech company preparing to launch an innovative new feature. The marketing team is abuzz with excitement, crafting messages for various channels and planning a high-profile partnership with a popular influencer. Yet, beneath this creative enthusiasm lies a complex web of regulatory requirements. Every claim and feature description must be meticulously scrutinized to ensure compliance – a scenario that once required hundreds of hours of manual review.

For decades, compliance and growth have been viewed as competing priorities in the financial industry. Compliance teams, tasked with safeguarding against regulatory breaches, were often seen as roadblocks to innovative product launches. However, this paradigm is shifting dramatically. With the right AI-powered tools, financial institutions can transform compliance from a necessary evil into a competitive edge.

A Staggering US$206 Billion in Costs

The financial sector faces unprecedented regulatory pressure. Since 2008, compliance costs have skyrocketed by over 60%. Studies show that the current cost of compliance for financial services worldwide is a staggering US$206 billion, equivalent to 12% of global research and development expenditures. These figures underscore the urgent need for more efficient compliance solutions.

In our work with financial institutions, we’ve seen a significant evolution in how they approach compliance. Initially, many of our clients turned to AI-powered solutions to streamline operations by automating repetitive manual tasks, freeing up teams to be more strategic. However, they quickly realized that the far greater ROI comes from enabling their marketing teams and partners to accelerate growth by creating and distributing more content across multiple countries and languages.

AI is revolutionizing marketing compliance. Advanced systems can now scan all materials before a campaign begins, ensuring they comply with regulatory requirements and internal policies. Once the marketing campaign launches, these systems continuously monitor various channels, including influencer and social media content, to detect, flag, and mitigate deviations in real-time. This capability is crucial in the age of rapid-fire social media marketing, where a single non-compliant post could lead to significant regulatory issues.

Transforming the Entire Compliance Lifecycle

Beyond marketing, AI is transforming the entire compliance lifecycle, covering everything from policy setting to enforcement, correction, and audit. These advanced systems support multiple layers of compliance, including communication and marketing compliance, across various channels such as chat, calls, emails, AI bots, social media, and websites in over 100 languages. This comprehensive oversight allows businesses to scale confidently, knowing they have a robust system in place to manage regulatory risks across a wide range of touchpoints and jurisdictions.

At the heart of this transformation is the financial services industry’s first compliance-dedicated large language model (LLM). With such platforms, compliance teams oversee and manage compliance risks effectively, automating policy enforcement, mitigating deviations, and streamlining audits. These systems can be customized to an organization’s unique requirements, learning and adapting over time.

The potential of AI in compliance is clear, and the market is responding. Recently, my company, which brings AI to compliance, closed an $18.5 million Series A funding round, led by Foundation Capital with participation from Amex Ventures.

Looking ahead, the future belongs to those who can turn compliance from a cost center into a strategic asset. In this new era, regulatory obligations are viewed as opportunities to innovate and excel.

Financial institutions must embrace these technological advancements and eliminate the false choice of compliance vs. growth. By doing so, they can meet regulatory requirements more efficiently and at the same time, unlock new avenues for growth and innovation. The convergence of AI and compliance goes beyond reducing risks – it’s about empowering businesses to operate with greater agility and confidence in an increasingly complex regulatory environment.

Imagine a fintech company preparing to launch an innovative new feature. The marketing team is abuzz with excitement, crafting messages for various channels and planning a high-profile partnership with a popular influencer. Yet, beneath this creative enthusiasm lies a complex web of regulatory requirements. Every claim and feature description must be meticulously scrutinized to ensure compliance – a scenario that once required hundreds of hours of manual review.

For decades, compliance and growth have been viewed as competing priorities in the financial industry. Compliance teams, tasked with safeguarding against regulatory breaches, were often seen as roadblocks to innovative product launches. However, this paradigm is shifting dramatically. With the right AI-powered tools, financial institutions can transform compliance from a necessary evil into a competitive edge.

A Staggering US$206 Billion in Costs

The financial sector faces unprecedented regulatory pressure. Since 2008, compliance costs have skyrocketed by over 60%. Studies show that the current cost of compliance for financial services worldwide is a staggering US$206 billion, equivalent to 12% of global research and development expenditures. These figures underscore the urgent need for more efficient compliance solutions.

In our work with financial institutions, we’ve seen a significant evolution in how they approach compliance. Initially, many of our clients turned to AI-powered solutions to streamline operations by automating repetitive manual tasks, freeing up teams to be more strategic. However, they quickly realized that the far greater ROI comes from enabling their marketing teams and partners to accelerate growth by creating and distributing more content across multiple countries and languages.

AI is revolutionizing marketing compliance. Advanced systems can now scan all materials before a campaign begins, ensuring they comply with regulatory requirements and internal policies. Once the marketing campaign launches, these systems continuously monitor various channels, including influencer and social media content, to detect, flag, and mitigate deviations in real-time. This capability is crucial in the age of rapid-fire social media marketing, where a single non-compliant post could lead to significant regulatory issues.

Transforming the Entire Compliance Lifecycle

Beyond marketing, AI is transforming the entire compliance lifecycle, covering everything from policy setting to enforcement, correction, and audit. These advanced systems support multiple layers of compliance, including communication and marketing compliance, across various channels such as chat, calls, emails, AI bots, social media, and websites in over 100 languages. This comprehensive oversight allows businesses to scale confidently, knowing they have a robust system in place to manage regulatory risks across a wide range of touchpoints and jurisdictions.

At the heart of this transformation is the financial services industry’s first compliance-dedicated large language model (LLM). With such platforms, compliance teams oversee and manage compliance risks effectively, automating policy enforcement, mitigating deviations, and streamlining audits. These systems can be customized to an organization’s unique requirements, learning and adapting over time.

The potential of AI in compliance is clear, and the market is responding. Recently, my company, which brings AI to compliance, closed an $18.5 million Series A funding round, led by Foundation Capital with participation from Amex Ventures.

Looking ahead, the future belongs to those who can turn compliance from a cost center into a strategic asset. In this new era, regulatory obligations are viewed as opportunities to innovate and excel.

Financial institutions must embrace these technological advancements and eliminate the false choice of compliance vs. growth. By doing so, they can meet regulatory requirements more efficiently and at the same time, unlock new avenues for growth and innovation. The convergence of AI and compliance goes beyond reducing risks – it’s about empowering businesses to operate with greater agility and confidence in an increasingly complex regulatory environment.

VP of Business Development at Sedric AI. Sedric AI has established a new, trusted standard for end-to-end marketing & communication compliance in financial services. Sedric enables the world’s best compliance teams to convert policies into processes, automate execution and reporting, and turn compliance into a driver of business growth.

Keep Reading

FinTech

-

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

-

Nium Launches Real-Time Bank Account Verification Across 50 Markets

Nium Launches Real-Time Bank Account Verification Across 50 Markets

Nium Launches Real-Time Bank Account Verification Across 50 Markets

Nium Launches Real-Time Bank Account Verification Across 50 Markets

Nium Launches Real-Time Bank Account Verification Across 50 Markets

Nium Launches Real-Time Bank Account Verification Across 50 Markets

Nium Launches Real-Time Bank Account Verification Across 50 Markets

Nium Launches Real-Time Bank Account Verification Across 50 Markets

Nium Launches Real-Time Bank Account Verification Across 50 Markets

Nium Launches Real-Time Bank Account Verification Across 50 Markets

-

B2C2 and OpenPayd Partner for Fiat Transactions in Crypto Trade Settlements

B2C2 and OpenPayd Partner for Fiat Transactions in Crypto Trade Settlements

B2C2 and OpenPayd Partner for Fiat Transactions in Crypto Trade Settlements

B2C2 and OpenPayd Partner for Fiat Transactions in Crypto Trade Settlements

B2C2 and OpenPayd Partner for Fiat Transactions in Crypto Trade Settlements

B2C2 and OpenPayd Partner for Fiat Transactions in Crypto Trade Settlements

B2C2 and OpenPayd Partner for Fiat Transactions in Crypto Trade Settlements

B2C2 and OpenPayd Partner for Fiat Transactions in Crypto Trade Settlements

B2C2 and OpenPayd Partner for Fiat Transactions in Crypto Trade Settlements

B2C2 and OpenPayd Partner for Fiat Transactions in Crypto Trade Settlements

-

Credit Agricole Takes Part in “Banking Conspiracy,” Cinkciarz.pl Claims

Credit Agricole Takes Part in “Banking Conspiracy,” Cinkciarz.pl Claims

Credit Agricole Takes Part in “Banking Conspiracy,” Cinkciarz.pl Claims

Credit Agricole Takes Part in “Banking Conspiracy,” Cinkciarz.pl Claims

Credit Agricole Takes Part in “Banking Conspiracy,” Cinkciarz.pl Claims

Credit Agricole Takes Part in “Banking Conspiracy,” Cinkciarz.pl Claims

Credit Agricole Takes Part in “Banking Conspiracy,” Cinkciarz.pl Claims

Credit Agricole Takes Part in “Banking Conspiracy,” Cinkciarz.pl Claims

Credit Agricole Takes Part in “Banking Conspiracy,” Cinkciarz.pl Claims

Credit Agricole Takes Part in “Banking Conspiracy,” Cinkciarz.pl Claims

-

Ebury Scores a Deal with Southampton FC to Support SMEs

Ebury Scores a Deal with Southampton FC to Support SMEs

Ebury Scores a Deal with Southampton FC to Support SMEs

Ebury Scores a Deal with Southampton FC to Support SMEs

Ebury Scores a Deal with Southampton FC to Support SMEs

Ebury Scores a Deal with Southampton FC to Support SMEs

Ebury Scores a Deal with Southampton FC to Support SMEs

Ebury Scores a Deal with Southampton FC to Support SMEs

Ebury Scores a Deal with Southampton FC to Support SMEs

Ebury Scores a Deal with Southampton FC to Support SMEs

-

ASIC Wants Purview on BNPL: Likely to Issue ‘Standalone’ Guidance

ASIC Wants Purview on BNPL: Likely to Issue ‘Standalone’ Guidance

ASIC Wants Purview on BNPL: Likely to Issue ‘Standalone’ Guidance

ASIC Wants Purview on BNPL: Likely to Issue ‘Standalone’ Guidance

ASIC Wants Purview on BNPL: Likely to Issue ‘Standalone’ Guidance

ASIC Wants Purview on BNPL: Likely to Issue ‘Standalone’ Guidance

ASIC Wants Purview on BNPL: Likely to Issue ‘Standalone’ Guidance

ASIC Wants Purview on BNPL: Likely to Issue ‘Standalone’ Guidance

ASIC Wants Purview on BNPL: Likely to Issue ‘Standalone’ Guidance

ASIC Wants Purview on BNPL: Likely to Issue ‘Standalone’ Guidance

-

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

-

Nium Launches Real-Time Bank Account Verification Across 50 Markets

Nium Launches Real-Time Bank Account Verification Across 50 Markets

-

B2C2 and OpenPayd Partner for Fiat Transactions in Crypto Trade Settlements

B2C2 and OpenPayd Partner for Fiat Transactions in Crypto Trade Settlements

-

Credit Agricole Takes Part in “Banking Conspiracy,” Cinkciarz.pl Claims

Credit Agricole Takes Part in “Banking Conspiracy,” Cinkciarz.pl Claims

Featured Videos

FM’s Andrea Badiola Mateos at LSEG’s Cyprus event

FM’s Andrea Badiola Mateos at LSEG’s Cyprus event

FM’s Andrea Badiola Mateos at LSEG’s Cyprus event

FM’s Andrea Badiola Mateos at LSEG’s Cyprus event

FM’s Andrea Badiola Mateos at speaking in a panel discussion at LSEG’s Cyprus event

FM’s Andrea Badiola Mateos at speaking in a panel discussion at LSEG’s Cyprus event

FM’s Andrea Badiola Mateos at speaking in a panel discussion at LSEG’s Cyprus event

FM’s Andrea Badiola Mateos at speaking in a panel discussion at LSEG’s Cyprus event

-

The Role of PAMM, MAM & Copy Trading in Business Growth Strategies | Webinar

The Role of PAMM, MAM & Copy Trading in Business Growth Strategies | Webinar

The Role of PAMM, MAM & Copy Trading in Business Growth Strategies | Webinar

The Role of PAMM, MAM & Copy Trading in Business Growth Strategies | Webinar

The Role of PAMM, MAM & Copy Trading in Business Growth Strategies | Webinar

The Role of PAMM, MAM & Copy Trading in Business Growth Strategies | Webinar

The copy trading market is projected to double in size, growing from $2.2 billion to $4 billion by the end of this decade. In light of this, brokers and financial institutions are increasingly adopting PAMM, MAM, and Copy Trading solutions to scale operations and drive profitability. In this insightful webinar, Sergey Ryzhavin, Product Owner at B2COPY, outlines the advanced features of the B2COPY platform, showcasing how it enhances Copy Trading, PAMM, and MAM performance. Sergey also explores strategies for using these tools to attract new clients, improve customer engagement, and create additional revenue streams. 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

The copy trading market is projected to double in size, growing from $2.2 billion to $4 billion by the end of this decade. In light of this, brokers and financial institutions are increasingly adopting PAMM, MAM, and Copy Trading solutions to scale operations and drive profitability. In this insightful webinar, Sergey Ryzhavin, Product Owner at B2COPY, outlines the advanced features of the B2COPY platform, showcasing how it enhances Copy Trading, PAMM, and MAM performance. Sergey also explores strategies for using these tools to attract new clients, improve customer engagement, and create additional revenue streams. 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

The copy trading market is projected to double in size, growing from $2.2 billion to $4 billion by the end of this decade. In light of this, brokers and financial institutions are increasingly adopting PAMM, MAM, and Copy Trading solutions to scale operations and drive profitability. In this insightful webinar, Sergey Ryzhavin, Product Owner at B2COPY, outlines the advanced features of the B2COPY platform, showcasing how it enhances Copy Trading, PAMM, and MAM performance. Sergey also explores strategies for using these tools to attract new clients, improve customer engagement, and create additional revenue streams. 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

The copy trading market is projected to double in size, growing from $2.2 billion to $4 billion by the end of this decade. In light of this, brokers and financial institutions are increasingly adopting PAMM, MAM, and Copy Trading solutions to scale operations and drive profitability. In this insightful webinar, Sergey Ryzhavin, Product Owner at B2COPY, outlines the advanced features of the B2COPY platform, showcasing how it enhances Copy Trading, PAMM, and MAM performance. Sergey also explores strategies for using these tools to attract new clients, improve customer engagement, and create additional revenue streams. 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

The copy trading market is projected to double in size, growing from $2.2 billion to $4 billion by the end of this decade. In light of this, brokers and financial institutions are increasingly adopting PAMM, MAM, and Copy Trading solutions to scale operations and drive profitability. In this insightful webinar, Sergey Ryzhavin, Product Owner at B2COPY, outlines the advanced features of the B2COPY platform, showcasing how it enhances Copy Trading, PAMM, and MAM performance. Sergey also explores strategies for using these tools to attract new clients, improve customer engagement, and create additional revenue streams. 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

The copy trading market is projected to double in size, growing from $2.2 billion to $4 billion by the end of this decade. In light of this, brokers and financial institutions are increasingly adopting PAMM, MAM, and Copy Trading solutions to scale operations and drive profitability. In this insightful webinar, Sergey Ryzhavin, Product Owner at B2COPY, outlines the advanced features of the B2COPY platform, showcasing how it enhances Copy Trading, PAMM, and MAM performance. Sergey also explores strategies for using these tools to attract new clients, improve customer engagement, and create additional revenue streams. 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

-

Join us at FMLS:24 to connect with global institutional brokers. Secure your spot today! #fmls24

Join us at FMLS:24 to connect with global institutional brokers. Secure your spot today! #fmls24

Join us at FMLS:24 to connect with global institutional brokers. Secure your spot today! #fmls24

Join us at FMLS:24 to connect with global institutional brokers. Secure your spot today! #fmls24

Join us at FMLS:24 to connect with global institutional brokers. Secure your spot today! #fmls24

Join us at FMLS:24 to connect with global institutional brokers. Secure your spot today! #fmls24

-

🌟 Explore cutting-edge solutions and connect with fintech leaders at FMLS:24!

🌟 Explore cutting-edge solutions and connect with fintech leaders at FMLS:24!

🌟 Explore cutting-edge solutions and connect with fintech leaders at FMLS:24!

🌟 Explore cutting-edge solutions and connect with fintech leaders at FMLS:24!

🌟 Explore cutting-edge solutions and connect with fintech leaders at FMLS:24!

🌟 Explore cutting-edge solutions and connect with fintech leaders at FMLS:24!

-

🤝 Meet industry leaders at the premier event for brokers – FMLS:24. Secure your spot today!

🤝 Meet industry leaders at the premier event for brokers – FMLS:24. Secure your spot today!

🤝 Meet industry leaders at the premier event for brokers – FMLS:24. Secure your spot today!

🤝 Meet industry leaders at the premier event for brokers – FMLS:24. Secure your spot today!

🤝 Meet industry leaders at the premier event for brokers – FMLS:24. Secure your spot today!

🤝 Meet industry leaders at the premier event for brokers – FMLS:24. Secure your spot today!